Ideenkapital – Investor Management

Individual Software

Project description

Between 1994 and 2011, the Ideenkapital Group, as a fund initiator, placed around EUR 2.9 billion in equity through closed-end fund investments for around 20,000 investors in the German investment market. Including additional borrowed funds, national and international investments with a total volume of EUR 4.3 billion were made. Since spring 2011, Ideenkapital has no longer designed and sold new fund investments and is concentrating on managing the existing assets and supporting investors until the end of the respective term of the originally 50 funds designed.

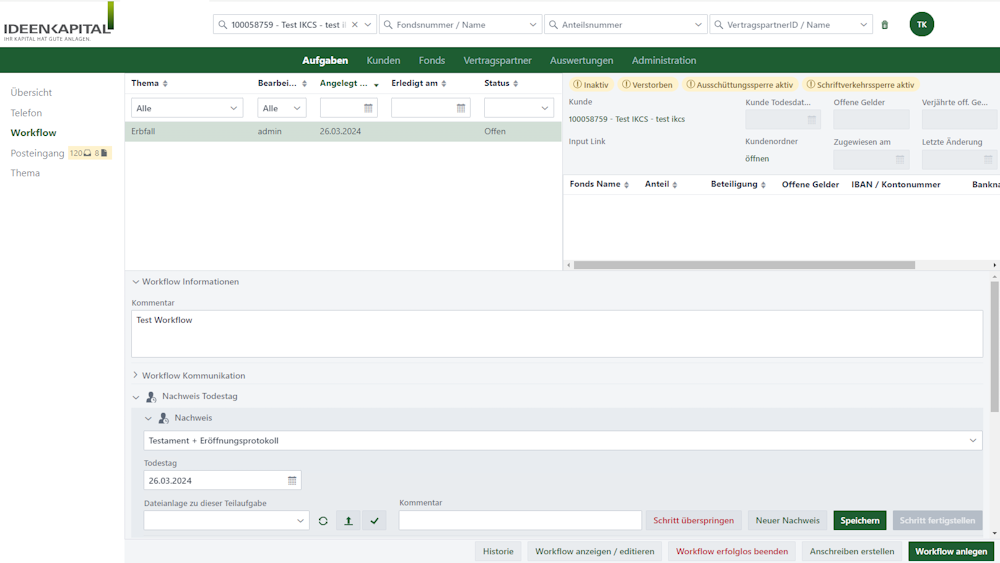

Since the existing software essentially supported data maintenance (master data, share data) as well as bookings and distributions, but not, for example, longer workflows such as processing an inheritance, a share transfer or account returns and EMA requests, a new software was required.

In addition to the master data management of funds, customers and shares as well as distributions, divisions and shareholder meetings, the new implementation of the web application “Investor Management” also contains additional functions for processing workflows (e.g. inheritance cases, distribution returns and EMA queries), an interface to the banking system for the processing of payments, an integration of the E-mail inbox as well as numerous reports and an interface to the document management system.

The application was realized using the following technologies: Java, Spring Boot, Vaadin, Quartz, REST, Apache POI, agorum API, JUnit, Mockito, Selenium, Testbench, Testcontainers, Liquibase, Mapstruct, MariaDB, Tomcat, Maven, GitLab, Jenkins, Sonar Qube, Nexus, Jira, Docker